As the national debt breaches the £2tn mark, here is our snapshot of what is happening

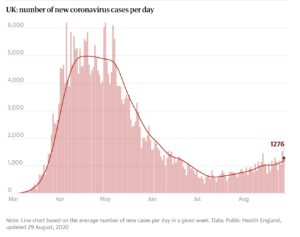

Increase in new daily Covid cases

Daily new coronavirus infections peaked in early April and fell between May and early July. Since then there has been an increase in daily cases – although some of this can be attributed to increased testing. Infections have risen in some places more than others, leading to local lockdowns and other restrictions. Infections are also rising in some European countries including Spain and France, leading to quarantine controls for travellers arriving in Britain. In the UK as of 27 August, 330,368 cases of coronavirus have been confirmed and 41,477 deaths.

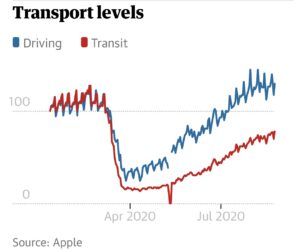

Driving rises above pre-pandemic levels

Transport levels

Driving on Britain’s roads has risen above pre-lockdown levels, as restrictions are gradually relaxed nationwide. According to Apple mobility data – which records requests made to Apple Maps for directions – driving is up by 19% compared with January. However, public transport use remains 30% down and is taking longer to recover due to the continuing risks to health. In a sign of reduced commuting, Department for Transport figures show car traffic remains lower during the week, while train journeys are still only a quarter of pre-Covid levels and London underground trips are 30% below normal. Cycling, however, has risen sharply.

Covid treatments boost stock market

FTSE 100 index

Treatments for Covid-19 and hopes that a vaccine can be developed have driven a recovery in global financial markets in the past month, fuelling optimism among investors that medical advances will limit further damage to the economy. The US approved a treatment using the plasma of recovered patients, while Oxford University scientists are making progress towards a vaccine. US stock markets laden with big tech companies – which are benefiting from more activity online during the pandemic – have hit record highs. The FTSE 100 has held steady in the past month, roughly unchanged at just over 6,000.

Petrol prices push up inflation

Consumer prices index

UK inflation unexpectedly rose in July after the largest monthly increase in petrol prices for almost a decade and a lack of summer sales on the high street as non-essential shops reopened. The consumer price index (CPI) measure of inflation rose to 1% from 0.6% a month earlier. Retailers normally slash prices in the summer before the arrival of autumn product ranges. However, clothing and footwear prices fell by just 0.7% between June and July, compared with a fall of 2.9% in 2019. Some prices rose due to businesses passing on the extra cost of buying personal protective equipment and putting in place distancing measures.

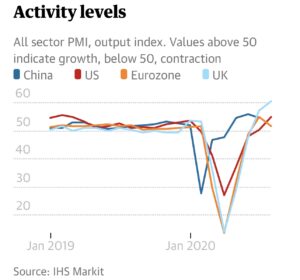

UK private sector bounces back

Activity levels

Britain’s private sector expanded at its fastest pace for seven years in August after the lifting of lockdown for most of the country, boosted by the release of pent-up demand. The IHS Markit CIPS flash UK composite output index rose to 60.3 in August, from 57 in July. A figure above 50 indicates expansion. Activity also increased in the US. However, growth slowed in the eurozone and China, raising fears for other countries following in the path of the first country to be struck by the pandemic.

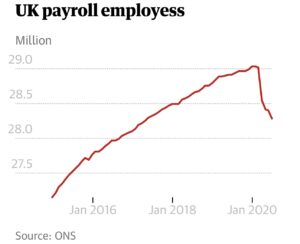

730,000 workers fall from UK payrolls

UK payroll employess

Almost three-quarters of a million jobs have been lost from company payrolls since the start of the coronavirus pandemic in March, as job losses begin to mount across the country. According to the Office for National Statistics, the number of workers on company payrolls fell by 730,000 between March and July, with the youngest and oldest workers most heavily affected. However, the pace of decline slowed in July with just 81,000 jobs lost since June. With millions of workers furloughed, the headline unemployment rate remained unchanged at 3.9%. However, economists expect the official jobless rate to rise dramatically this autumn as the scheme is withdrawn.

Retail sales rise above pre-pandemic levels

Retail sales

Retail sales in July jumped above pre-pandemic levels after the first full month since the reopening of non-essential shops. In a sign of pent-up demand being unleashed, the total value of sales increased by 4.4% and volume of sales by 3.6% compared with June. Internet shopping dipped slightly as physical stores reopened, but online sales remained more than 50% higher than in February, reflecting the difficulty facing some retailers as they close stores and cut jobs. Some sectors performed better than others, including food and DIY, while clothing sales remained 25.7% lower than in February.

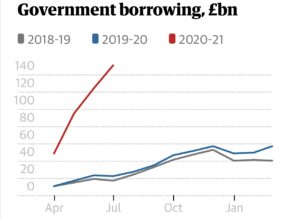

UK national debt breaches £2tn mark

Government borrowing, £bn

The government’s emergency response to the coronavirus pandemic and shrinking tax receipts as Britain falls into recession has triggered a sharp increase in public borrowing. Against this backdrop, national debt has risen to more than £2tn and now exceeds the size of the UK economy for the first time since the early 1960s. Borrowing in the financial year to July is estimated to have been £150.5bn – as much as £128.4bn more than in the same period last year. The chancellor, Rishi Sunak, has said “tough choices” must be made to tackle the size of the deficit. However, economists say the cost of borrowing is at a record low and warn against cutting back state support too soon.

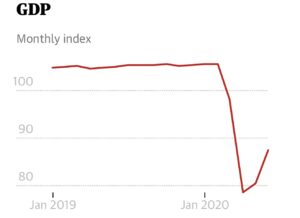

Britain confirmed in worst ever recession

GDP

Britain’s economy is in the deepest recession since modern records began, after gross domestic product (GDP) fell by more than any other major nation in the second quarter. GDP plunged by 20.4% in the three months to the end of June, following a decline of 2.2% in the first three months of the year. Economists define a recession as two consecutive quarters of falling GDP. The later launch of lockdown and slower relaxation of restrictions were among key reasons for the UK suffering the sharpest fall of any G7 and EU nation. However, growth continued to strengthen in July as lockdown was gradually lifted. GDP grew by 8.7% on the month, although still remains 17.2% below its level in February before the pandemic struck.

Stamp duty cut drives up house prices

House prices

House prices have gone through a post-lockdown mini-boom, fuelled by last month’s temporary stamp duty cut. Following the intervention by the chancellor to prop up the market, average property values jumped by 1.6%, or £3,770, month on month in July, according to Halifax, Britain’s biggest mortgage lender. After the market was effectively put in the deep freeze during lockdown, house prices had slumped in the previous four months. However, economists said the return to growth could be short-lived as the economy grapples with recession, and unemployment mounts.

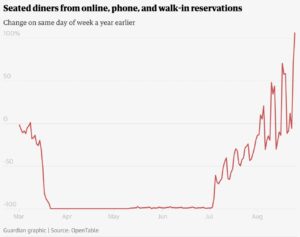

And another thing we’ve learned this month: ‘eat out to help out’ serves up restaurant boom

Leave A Comment