A 1997 Court of Appeals (CA) ruling found no proof to pin down presidential candidate Ferdinand “Bongbong” Marcos Jr. on tax evasion charges, but cited him for failure to file income tax (ITR) returns, which carries just a fine.

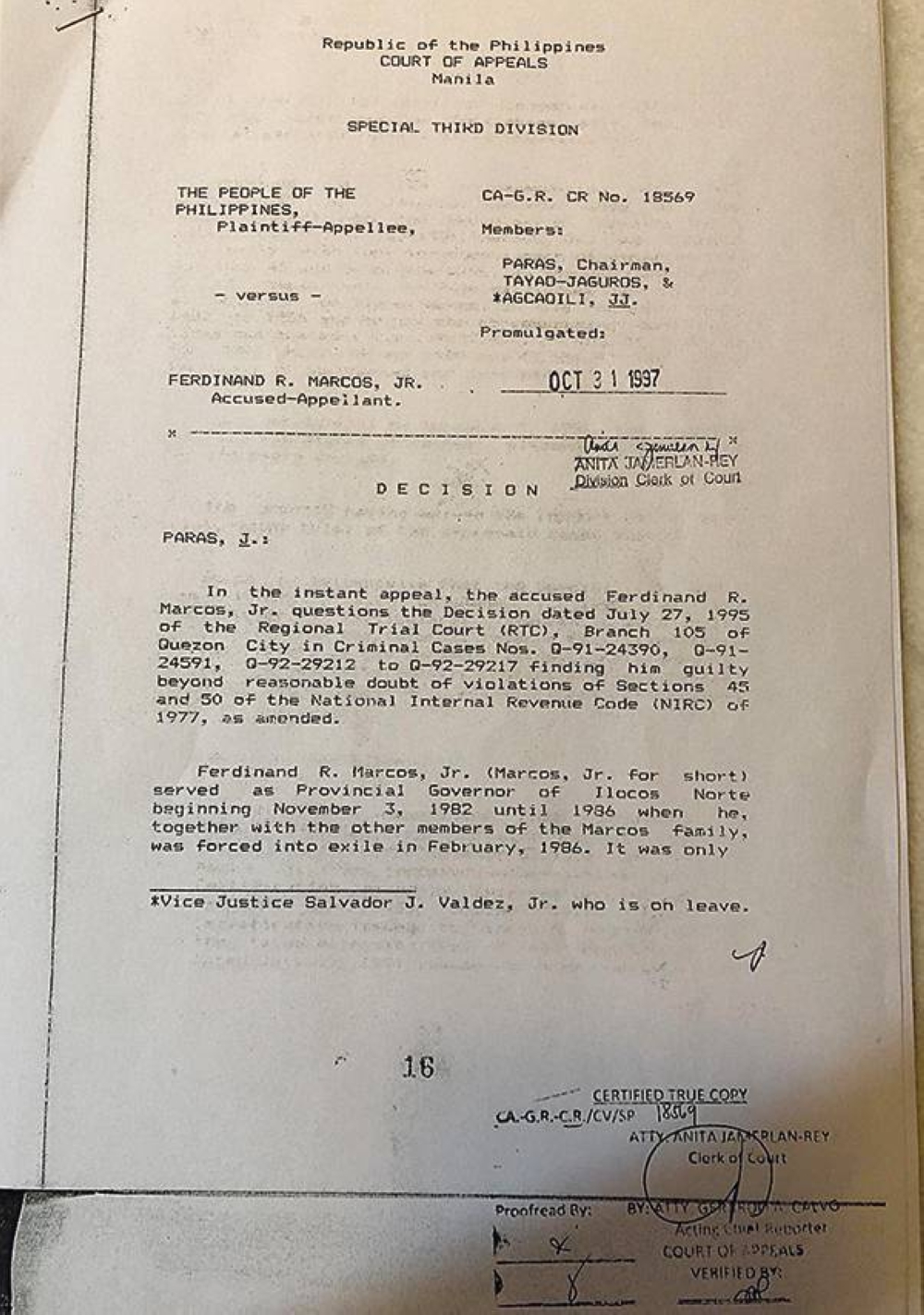

The Oct. 31, 1997 ruling of the court’s Special 3rd Division was penned by then Associate Justice Gloria Paras as the division’s chairman and concurred by Associate Justices Lourdes Tayao-Jaguros, the senior member, and Oswaldo Agcaoili, the junior member.

Retired Supreme Court Justice Antonio Carpio has claimed that the son of ousted President Ferdinand Marcos committed tax violations, grounds for his disqualification as a candidate.

On Tuesday, a group of political detainees, human rights and medical organizations petitioned the Commission on Elections (Comelec) to cancel Marcos’ certificate of candidacy (CoC) for president.

In the 57-page petition, the group claimed that Marcos, the Partido Federal ng Pilipinas standard bearer, is not eligible to run for public office after the Quezon City Regional Trial Court convicted him in 1995 for tax evasion.

Marcos brought the case to the appellate court, which overturned the tax evasion conviction.

The Paras ruling said the Bureau of Internal Revenue (BIR) did not issue a tax assessment against Marcos before he was charged in court, denying him the right to due process.

An assessment would have apprised him of any income tax liability and given him the chance to settle his dues, the ruling stated.

Based on the accounts from the ruling, the notices from the BIR were received by a caretaker of Marcos on Aug. 23, 1991 and Sept. 12, 1991. The cases were filed before the Quezon City court between Sept. 20, 1991 and Oct. 10, 1991, not enough time for Marcos to react to the notices and pay the deficiencies, the ruling noted.

Eight cases were filed against Marcos for failure to file income tax returns and not paying tax dues.

On July 27, 1995, the Quezon City Regional Trial Court convicted Marcos in all eight cases, sentenced him to seven years in prison and fined him P64,000.

The CA acquitted Marcos of the tax evasion charges but affirmed the guilty verdict on the failure to file income tax returns.

He was ordered to pay a fine of P32,000 for not filing ITRs for the period from 1982 to 1985.

Marcos appealed the case to the Supreme Court only to withdraw it later. He settled the fines on Oct. 31, 1997.

Several justices who talked to The Times said it was very clear that Marcos cannot be further prosecuted for tax evasion after being acquitted by the CA because of the principle of res judicata.

One magistrate, who spoke on condition that the person is not identified, commented: “In view of the above circumstances, and considering that the appellant was then out of the country, a fact known to the appellee (BIR) and could not, therefore sufficiently react to the notices then sent to him, it was as if no opportunity had been given him to present his side of the case and to pay the tax liabilities before he was prosecuted.”

Another magistrate told the Times that Marcos cannot be disqualified since a penalty involving a fine does not carry the effects of moral turpitude.

On Thursday, an election law professor also doubted if the disqualification case against Marcos will prosper.

Alberto Agra from the Ateneo de Manila University said the petition “lacked a crucial component.”

One of the bases for barring someone from holding public office is if that person had been sentenced to more than 18 months or a crime involving moral turpitude, Agra said.

“Ang nangyari siya ay nahatulan pero ang kanyang parusa ay walang imprisonment (What happened was he was sentenced, but his punishment did not entail imprisonment),” he said.

In a statement on Thursday, Marcos’ camp said Agra’s position showed the “ill-natured intent of those pushing for his disqualification.”

with Bernadette E. Tamayo

Leave A Comment