Manila, Philippines – The Philippines’ inflation rate rose to 3.7% in March, driven by higher food prices and transportation costs for the month.

The 3.7% rate reported by the Philippine Statistics Authority on Friday, April 5, is higher than February’s 3.4%, but lower than the 7.6% recorded in March 2023.

The 3.7% rate for March is near the top end of the government’s 2% to 4% target range for inflation. It also means that the inflation rate has risen for the second month in a row since being on a downtrend for four straight months

March’s inflation rate was primarily driven by food and non-alcoholic beverages (from 4.6% in February to 5.6% in March); transport (from 1.2% to 2.1%); and restaurants and accommodation services (from 5.3% to 5.6%).

Year-to-date, average inflation stands at 3.3%.

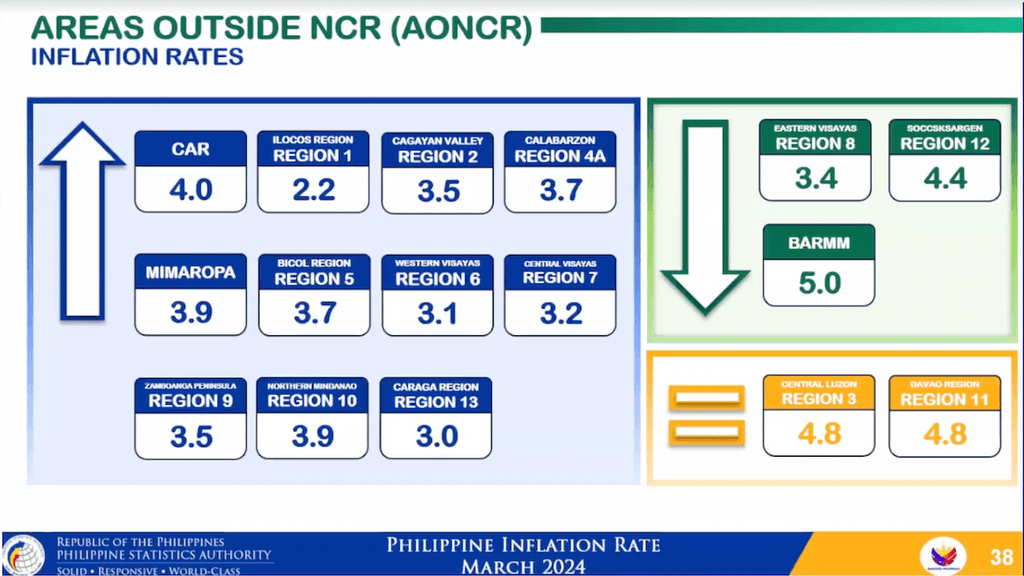

In the National Capital Region, inflation also inched up to 3.3% in March from February’s 3.2%. Areas outside NCR also saw higher inflation at 3.8% from 3.5%.

By region, the Bangsamoro Autonomous Region in Muslim Mindanao posted the highest inflation rate at 5%, though this is lower than its previous rate of 5.3%. In contrast, the Ilocos Region registered the lowest rate at 2.2%, but this is slightly higher than its previous 2%.

For the bottom 30% income households, inflation rose to 4.6% in March from 4.2% in February. Food and non-alcoholic beverages; housing, water, electricity, gas, and other fuels; and transport were the main sources of the acceleration for this segment.

Higher inflation, slower BSP rate cuts

Earlier, the Bangko Sentral ng Pilipinas (BSP) estimated March’s inflation rate would settle between 3.4% and 4.2%, with the low end matching February’s figure and the high end breaching the government’s target range.

“Continued price increases of rice and meat along with higher domestic oil prices and electricity rates are the primary sources of upward price pressures for the month. Meanwhile, lower prices of fruits, vegetables, and fish along with the peso appreciation could contribute to downward price pressures,” the BSP said in a press release on Monday, April 1.

The higher inflation rate would likely prompt the central bank’s Monetary Board to stay hawkish and keep its key policy rate unchanged for longer. In its last monetary policy meeting in February, the Monetary Board decided to keep rates paused at 6.5% since an off-cycle hike in October 2023. The Monetary Board will again decide on changes to its key policy rate on Monday, April 8.

With inflation rising, BDO Trust and Investments Group chief investment officer Frederico Ocampo predicts that the BSP will not bring down rates until the latter part of 2024.

“Our view was March all the way to May will be a critical period. Critical in the sense that inflation will pierce 4%. And even the BSP shared that concern. And that’s why we expected that they are not cutting interest rates anytime soon,” Ocampo said on Thursday, April 4.

“As inflation goes down again below 4%, and becomes a trend – not only one point, but a trend – that’s when they will cut interest rates,” he added.

Leave A Comment