From container ship queues in the US to power cuts in China, the post-Covid pickup in activity is taking a toll

As the Covid-19 pandemic eases and national economies emerge from suspended animation, demand for energy, labour and transport has surged. That sudden acceleration is putting a huge strain on the just-in-time, cross-border supply chains that keep factories open and shelves stocked. From Liverpool to Los Angeles, Beijing to Berlin, the world is in the grip of a supply crunch. Here, Guardian correspondents report on how the fallout is affecting six big economies.

United States

Off the coast of Los Angeles a record-breaking flotilla of container ships is waiting to unload goods. With the holiday season approaching, companies across the US predicting shortages and price rises for everything from artificial Christmas trees and sports goods to Thanksgiving turkeys. Retailers warn that basics including toilet paper could once again be in short supply.

Some experts predict 80% of the US will be vaccinated against coronavirus by the end of the year, but the pandemic’s impact will last far longer than that as the broken links in the global supply chain continue to drag down the economy.

Logjams of container ships are only one part of the story. The US is also experiencing a massive labour shortage, especially in the leisure and entertainment sector. There were a record 10m job openings in the US at the end of June. “Help wanted” signs can be spotted in restaurant windows across the country.

Republicans have blamed pandemic-related increases in unemployment benefits for the lack of workers. Those benefits have ended but there is as yet little evidence that the industries hardest hit are gaining enough workers. Low wages have led millions to reconsider their careers during the pandemic, a phenomenon known as the Great Resignation. At the same time, lack of affordable childcare and the continuing closure of some schools has led many people to drop out of the workforce.

With coronavirus still a big threat in many of the countries the US relies on for goods, the crisis looks set to continue for some time. “It is frustrating to acknowledge that getting people vaccinated and getting Delta under control, 18 months later, still remains the most important economic policy that we have,” the Federal Reserve chair, Jerome Powell, said this week. “It is also frustrating to see the bottlenecks and supply chain problems not getting better – in fact, at the margin, apparently getting a little bit worse.” Dominic Rushe in New York

China

The lights are beginning to go out on large parts of China’s economy. The investment banks Nomura and Goldman Sachs have downgraded their forecasts for growth in the world’s No 2 economy in the wake of power cuts that have idled factories and are also extending already long delays at ports.

Electricity cuts to entire sections of Shenyang, in northern Liaoning province, have meant traffic lights haven’t worked for a week, raising safety fears for the city’s many cyclists. “It’s quite inconvenient to ride in the dark,” one resident, Zhu Meiying, told the South China Morning Post. “For people who drive, they have car lights. But for people who ride bicycles it’s quite dangerous. Street lights on some roads have to be kept on because it’s about lives. Right?”

Zhu questioned what the government’s plans were to address the problem. Liaoning province says rationing is the only thing stopping the power grid from collapsing. Some compounds are without power during daylight hours, cutting off water supply and elevators, even in high rises.

Footage on social media showed a family trapped in an elevator when the power went out, with many commenting that the situation made them feel as if they were living in North Korea. Others described power cuts during visits to hospital.

In a since deleted post, one resident of the north-east said their family of three nearly died of carbon monoxide poisoning after power cuts stopped the exhaust fan from working and the family burned coal briquettes to stay warm.

The situation has worsened so much that China has asked Russia to increase the amount of electricity it sends to its neighbour via transmission lines that can carry 7bn kilowatt hours a year.

Lauri Myllyvirta, the lead analyst at the independent Centre for Research on Energy and Clean Air, said China had been caught out. “When fuel prices started to rise on the back of the global recovery, power plants cut back on coal purchases and have been running down their stocks for months,” she said. “Now this has meant that plants have run out of coal and are reluctant to purchase more as prices have skyrocketed.” Helen Davidson in Taipei

Germany

A 14.3% surge in energy prices in Germany% and the knock-on effect on petrol prices (up 20%) and foodstuffs (4.9%) have all contributed to September’s inflation rate rise to 4.1%, the highest in Germany in almost 30 years.

This is put down to growing demand, a shortage in supply and a lack of alternative energy sources. There are suspicions that Russia is artificially holding back supplies in order to increase pressure for the opening of the Nord Stream 2 pipeline, a charge the Kremlin vehemently denies.

The Bundesbank predicts inflation will rise to 5% by the year’s end. Driving prices upwards are a lift in the VAT rate, after it was lowered temporarily last year to help businesses cope with the pandemic, as well a rise in CO2 emission tariffs and scarcity of metals, wood and semiconductors.

Despite full order books, these supply frictions are expected to continue at least until the end of the year and to cost the economy €40bn, the effect of which will mainly be felt in 2022. GDP of 2.5% is predicted this year, accelerating to 5.1% next year.

However, there has been no talk as yet of a “crisis”, “emergency” or “panic” in Germany and while many manufacturers are feeling the pinch from the friction in supply chains, the average consumer, though often facing longer than usual waits for the delivery of luxury goods (furniture, electronic products, cars), is not experiencing empty supermarket shelves.

The issues of supply chain problems together with a shortage of workers prompted the carmaker Opel to announce on Thursday that it was temporarily shutting down a plant that produces hybrid vehicles in the city of Eisenach. Employees will be furloughed, until the factory reopens, hopefully sometime next year, “supplies permitting”.

Despite almost full employment, a longstanding labour shortage – currently about 400,000 workers a year – is a big issue, hampering overall economic growth and making itself felt in everyday life, mainly in the care industry, the health sector, skilled manufacturing, IT, engineering, and every skilled craft and trade from plumbers to carpenters.

There is a shortage of 60,000 to 80,000 road haulage workers, and economists warn of a demographic crunch, with more people due to go into retirement than are in active employment.

A growing number of German workers including train drivers, healthcare staff and workers in the motorhome industry have gone on strike in recent weeks, demanding higher pay amid rising inflation, which has raised fears of an inflationary spiral.

Marcel Fratzscher, of the German Institute for Economic Research, speaking on the broadcaster DLF, said the government could have to intervene on rents. Most German workers do not own their homes. But he described what was happening as a “normalisation” after the pandemic.

“Many people in Germany are scared of the future … but I see this as a luxury problem,” he said. “The rise in inflation is a welcome normalisation after the temporary suppression of prices during the pandemic. There is absolutely no reason to panic.” Kate Connolly in Berlin

Russia

As energy prices soar elsewhere, Russia finds itself in the enviable position of being the world’s largest net oil and gas exporter combined.

While Russian state television has gloated over videos of British drivers queueing for petrol, the Kremlin has told Europeans that the sooner its Nord Stream 2 pipeline is opened, the quicker gas prices will stabilise.

It is hard to shock a Russian economy that has done so much to shock itself, unilaterally banning western imports of meat, fruit, vegetables and dairy in 2014. Yet there are shortages: high-end Moscow restaurants say they cannot find high-quality marbled beef – the good stuff is being exported at higher prices to China – or octopus from Indonesia, normally brought by container ships.

Food inflation is at a record 7% annual rate, its highest in five years, an issue the Kremlin did its utmost to keep under wraps before parliamentary elections last month.

And then there is the mysterious cup-of-noodle shortage of 2021. In regional citiessuch as Krasnoyarsk, the popular doshirak dried noodles have disappeared from shelves amid rumours of a factory shutdown, worker shortages or perhaps rising prices of ingredients. Noodle producers and even regional officials have denied a run on ramen even as prices are reportedly rising for the remaining packs of the most popular flavours, spicy beef and chicken.

And hotels and restaurants are reporting a “catastrophic” shortage of workers, partly due to rising prices and partly due to Russia’s migrant crisis. Construction and agriculture have been hit by a shortage of an estimated 600,000 workers from Central Asia who did many of the hardest jobs but left during the Covid-19 crisis. Andrew Roth in Moscow

United Kingdom

In the summer, Britain’s recovery was threatened by a “pingdemic” that forced hundreds of thousands of workers to self-isolate after they came into contact with someone with Covid-19.

Only weeks after ministers scaled back the test-and-trace system to prevent businesses and public services from closing due to a lack of staff, petrol shortages have again prevented large swathes of the workforce from travelling to the office, school, factory or, in the case of care workers, reaching housebound patients.

It is an episode that is rapidly having economic consequences as it overlaps with shortages of lorry drivers and interruptions to global supply chains that have pushed up prices in everything from computer chips to liquified natural gas.

Government critics have blamed a lack of preparation for the consequences of Brexit that have made supply bottlenecks affecting every country that much worse.

The economy remains 3.5% smaller than it was before the pandemic hit. Manufacturing, which has boomed as consumers unable to eat out bought things for their homes, has had a better time but still remains about 2.5% smaller than its previous high in 2019.

A slowdown in activity across all sectors and regions in recent months is expected continue for the rest of the year as persistent shortages of key staff and supplies hinder any plans business might have had to expand going into 2022.

The British Chambers of Commerce forecasts that government efforts to encourage business investment will fall and a 2.5% contraction is likely this year.

Consumers, even those who have massed huge savings over the past 18 months, are also expected to become more circumspect in their shopping habits after a sharp rise in inflation that the Bank of England forecasts will exceed 4% by the end of the year.

A sudden rise in gas bills caused by an international shortage of supply will only push inflation higher still. Without extra support, many families could see their living standards fall. Phillip Inman in London

Australia

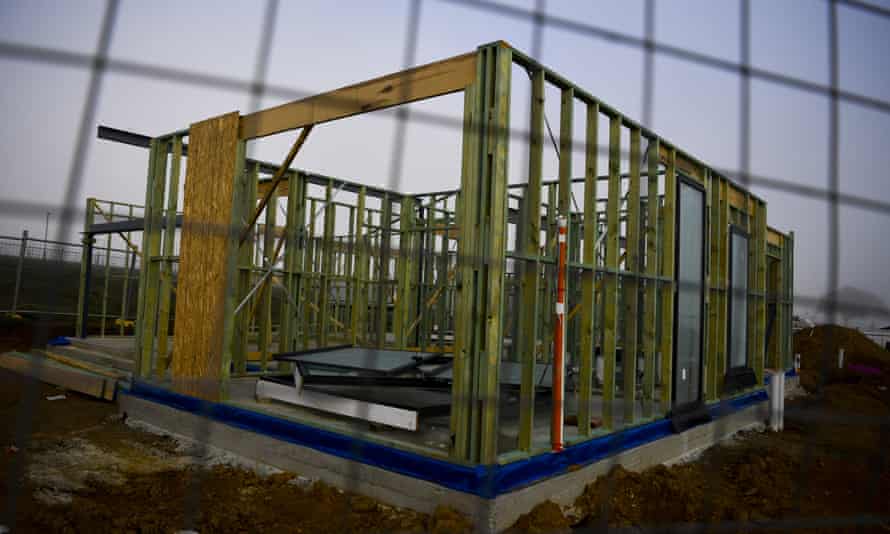

Shortages of timber, steel and other materials are causing havoc in Australia’s huge construction industry and builders are struggling to keep up with demand.

With house prices rising at their fastest rate since 1989 owing to post-pandemic demand and government stimulus, companies are scrambling to get hold of supplies and prices are said to be “going through the roof”.

Adam Robson, who runs Prekaro, a design and construction business in Gold Coast, Queensland, said delivery times for steel and timber have blown out from four weeks to four or five months amid the supply squeeze.

“You used to be able to buy timber off the shelf but you can’t do that any more. A lot of it comes from China and India and we just can’t get enough containers into the ports,” he said.

Australia is expected to increase output in its economy by 4% this year, according to the OECD, despite its two most populous states – New South Wales and Victoria – being in lengthy lockdowns. The Reserve Bank of Australia said this week that it expected shipping costs and higher wages to push inflation above its target.

A lack of migrant labour has not helped either, pushing up costs further. “Demand is so high there aren’t enough tradies in the country,” Robson said. “Electricians and chippies now dictate their prices because we can’t even get people in on 451 [migrant worker] visas.”

In a sign of how countries could begin to turn away from long global supply chains, the Master Builders Australia group has called on the government to plant an extra 250,000 trees a year to protect the country against timber shortages in the future.

“The housing construction industry is the engine room of the Australian economy and it needs a consistent, reliable domestic timber supply,” said the group’s chief executive, Denita Wawn. “As the timber shortages of the past 18 months have shown, we cannot rely on imports to fill the gap when we have increased construction activity – we need to act now.” Martin Farrer in Sydney