Retaliations and escalations eventually imposed tariffs on $370 billion in Chinese goods before the Phase 1 deal was signed in January, committing Beijing to boost purchases of U.S. farm and manufactured goods, energy and services by $200 billion over two years.

Thus far, the tariffs have reduced imports of goods from China but have not significantly altered the global U.S. goods and services trade deficit. tmsnrt.rs/2HLPKvh

Graphic: Tariffs have little impact on total U.S. trade deficit Tariffs have little impact on total U.S. trade deficit –

Companies responded by diversifying supply chains, shifting some production out of China – but mostly to other low-wage countries, such as Vietnam and Mexico, not to the United States. tmsnrt.rs/2Jg8mnz

Graphic: U.S. trade deficit substitution U.S. trade deficit substitution –

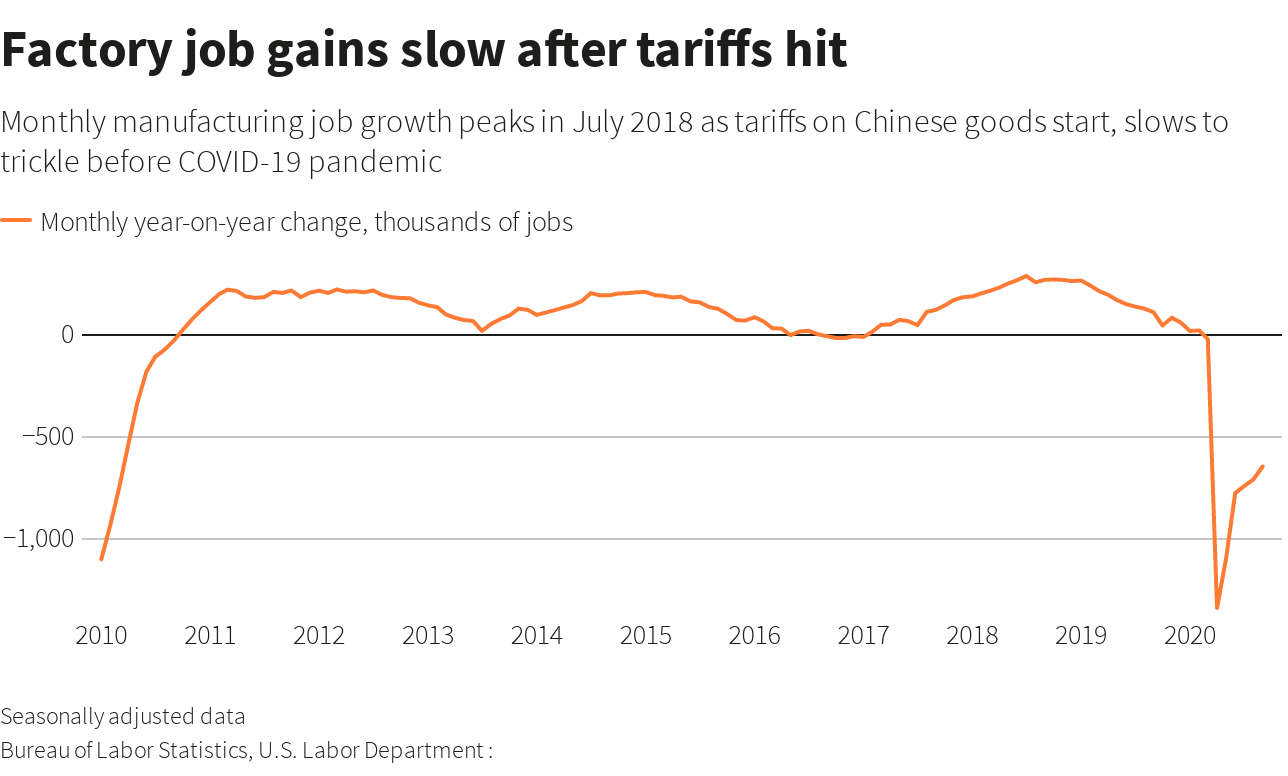

One of Trump’s goals was to increase American manufacturing jobs. The numbers have grown since he took office in 2017, partly due to a massive corporate tax cut. But manufacturing employment growth slowed after he launched the tariffs in 2018, becoming a trickle before the coronavirus pandemic hit in early 2020. tmsnrt.rs/2HLIeQV

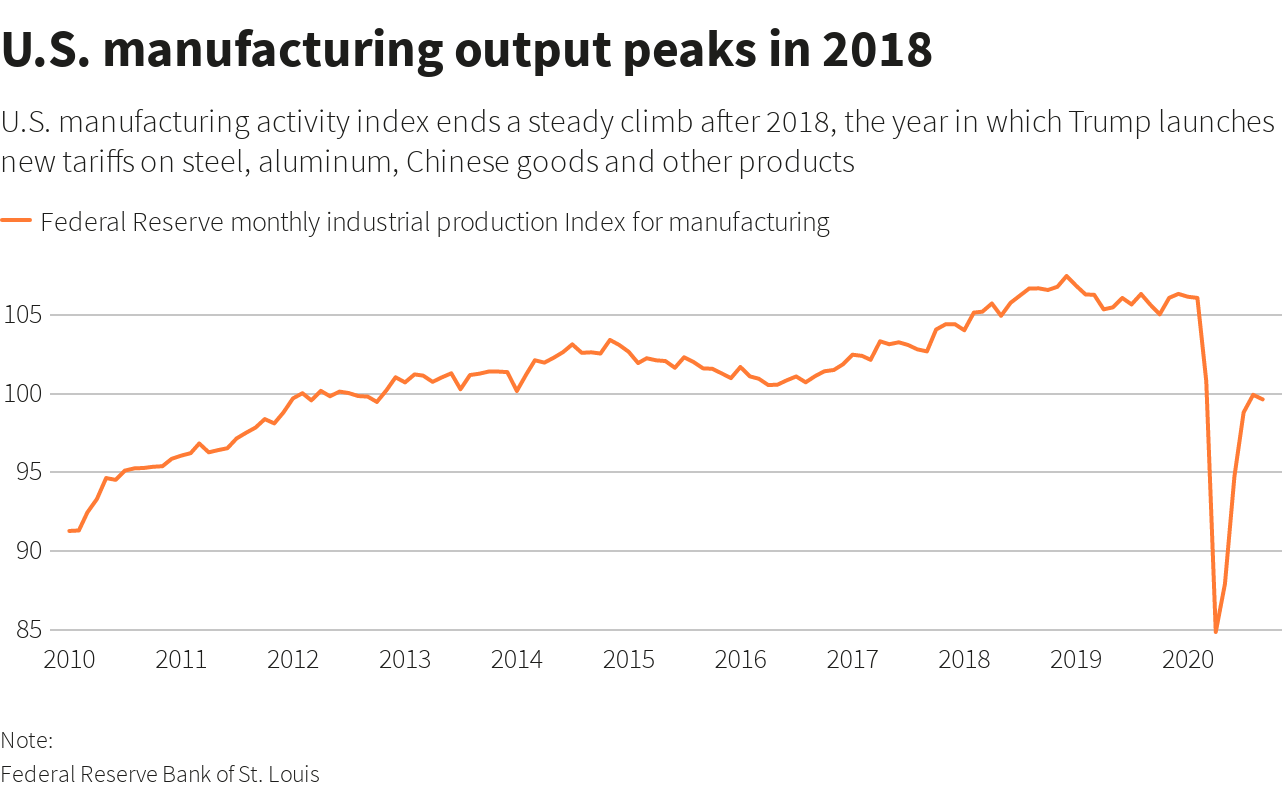

The Federal Reserve’s measure of U.S. manufacturing output also peaked in 2018. tmsnrt.rs/2HFFoNd

Graphic: Factory job gains slow after tariffs hit Factory job gains slow after tariffs hit –

Graphic: U.S. manufacturing output peaks in 2018 U.S. manufacturing output peaks in 2018 –

STEEL SLIDE

Trump angered U.S. allies in Europe, Asia and the Americas by imposing 25% tariffs on steel and 10% on aluminum in 2018 on national security grounds.

The tariffs prompted new investment in the sector and restarts of some idled mills, including here U.S. Steel Corp’s X.N Granite City Works in Illinois. But the hiring renaissance was short-lived as lower prices caused some closures, including one of two blast furnace at Granite City, where Trump heralded the industry’s renaissance in July 2018. tmsnrt.rs/31OH120

Graphic: U.S. iron and steel mill jobs rise, fall after tariffs U.S. iron and steel mill jobs rise, fall after tariffs –

Steel industry executives have argued that without the tariff protections, domestic steelmakers would be in far worse shape because of a global production glut largely centered in China. The tariffs have cut the market share of imports, allowing domestic steelmakers to utilize more of their capacity. tmsnrt.rs/3kDYe5E

Graphic: U.S. steel mill capacity use rises, dips, plunges U.S. steel mill capacity use rises, dips, plunges –

“NO DISASTERS”

Backers of Trump’s trade strategy argue that it did not lead to the major dislocations predicted by industry and won bigger concessions from China than any previous U.S. president did.

It pushed U.S. companies to diversify away from China and move some critical supply chains to the United States, said Stephen Vaughn, former general counsel at the U.S. Trade Representative’s office.

“All the sorts of disasters that people on the other side predicted literally never happened,” said Vaughn, now a trade partner at the King and Spalding law firm. “Even if you assume that all of the tariffs were paid by consumers, an $80 billion tax increase was never going to tank a $22 trillion economy.”

While Trump’s Phase 1 trade deal is now starting to boost agricultural exports to China after a slow start amid the COVID-19 pandemic, it failed to address many of the issues that really matter to U.S. companies. These include China’s technology transfer policies, industrial subsidies and barriers to digital services access in China.

“There’s still a legitimate question about what all this pain was paying for,” said Nasim Fussell, who served until August as the Republican trade counsel on the U.S. Senate Finance Committee. “There will be pressure from stakeholders to work towards a Phase 2” to address more substantive issues, added Fussell, now a trade lawyer at Holland and Knight.

But China remains barely more than halfway to its first year purchase targets on the Phase 1 trade deal, particularly for manufactured goods during the COVID-19 pandemic, according to trade data here calculations by Chad Bown, a senior fellow with the Peterson Institute for International Economics.

Economic factors such as commodity prices, Chinese tariffs, slack demand for air travel and a swine flu epidemic in China are weighing heavily on the export flows, Bown said.

“The dictum of ‘You need to buy more’ doesn’t necessarily seem to work.”