New Zealand’s housing boom remains the second-fastest in the world in terms of house price growth since the global pandemic, new figures show.

Research from global real estate agency Knight Frank found that house prices in New Zealand grew 25.9% in the 12 months to the end of June, the highest rate of growth the country’s housing market had seen since 2003.

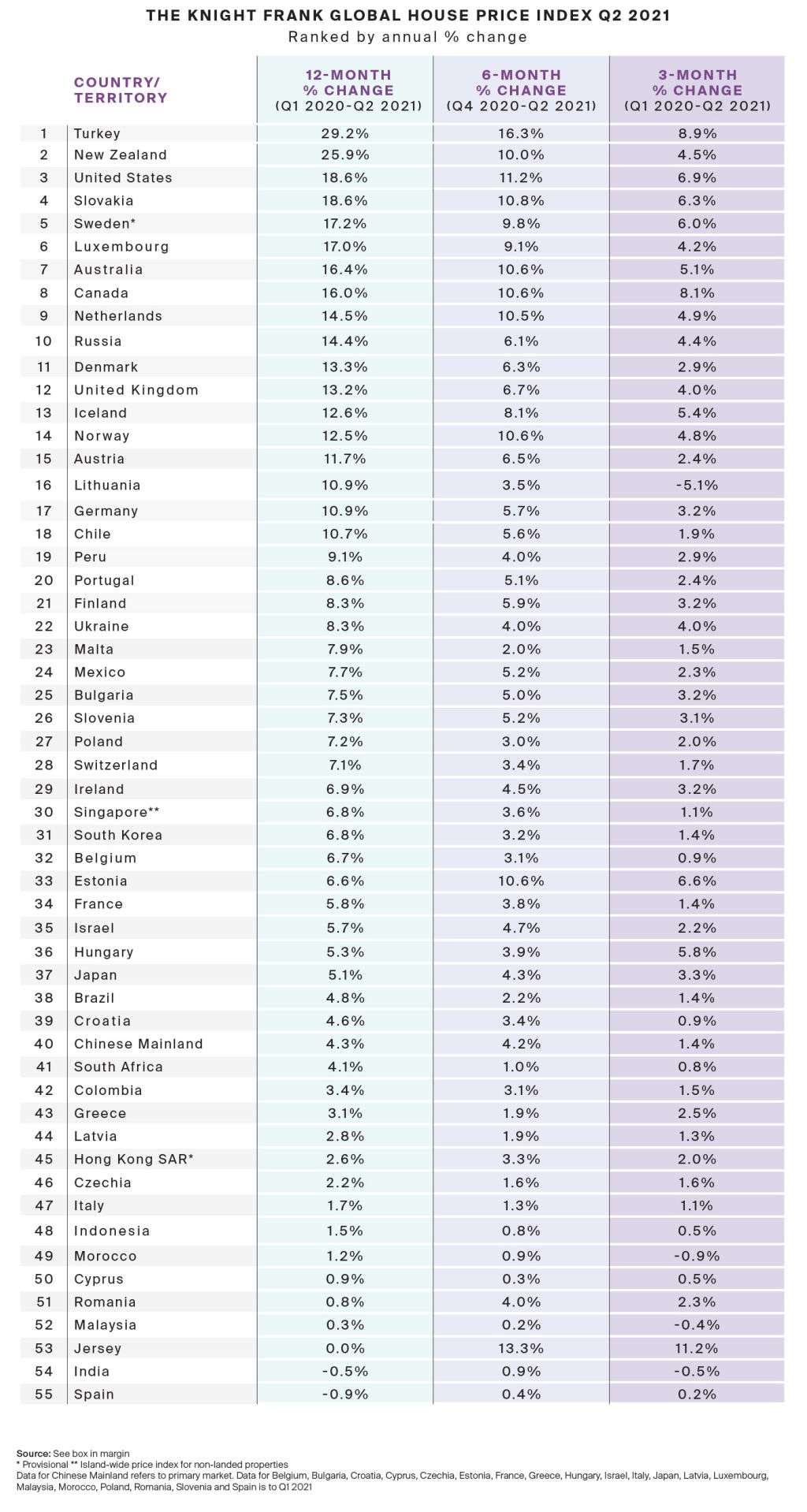

New Zealand ranked second out of 55 countries on Knight Frank’s Global House Price Index – for the third quarter in a row. Turkey, where house prices have risen 29.2% over the year to June was ranked first.

Australia, which has seen annual house price growth of 16.4%, was ranked seventh, up from 18th on the index in the previous quarter. The US was ranked third and the UK 12th. At the bottom of the table was Spain, where house prices have fallen 0.9% since the Covid crisis began.

Globally, house prices are rising at their strongest rate since Q1 2005, the research suggests.

“The pandemic-induced housing boom continues with prices rising by 9.2 per cent on average across 55 countries and territories in the year to June 2021,” Knight Frank’s researchers said.

But despite the strong growth there are signs of softening demand in some markets, including New Zealand, where house price growth for the three months to June was 4.5%, down from 5.3% in the previous quarter.

The research cited the prospect of interest rate rises in New Zealand as “likely to weigh on buyer sentiment in the medium term” but suggested that the latest Covid lockdown could actually boost the housing market.

“Recent tighter restrictions in South East Asia, New Zealand and Australia may yet spark renewed activity as lockdowns shine a light on homes and lifestyles,” the report said.

The Knight Frank Global House Price Index Q2 2021. Photo / Supplied

Independent economist Tony Alexander says New Zealand’s high ranking is no surprise.

“When you’ve got a 37 per cent increase in prices from May of last year you know you’re going to be popping up at the top of a lot of charts that are out there,” he told OneRoof, citing record low interest rates and FOMO (fear of missing out) as the main drivers of the lift.

“People saw the ball rolling and have jumped into it [the housing market]. I think our mindset is still on housing and the Government is working to change that over time but it’s going to be a slow burn.”

Tony Alexander: “They’re not coming home, of course, but we believe it’s going to happen.” Photo / Fiona Goodall

Part of the drive for Kiwis to buy houses, Alexander said, was the fear that thousands and thousands of New Zealanders living overseas would come home and buy all the houses.

“They’re not coming home, of course, that’s completely false, but we believe it’s going to happen,” he said.

“That probably is a unique feature for New Zealand. There are 660,000 of us in Australia and we silly Kiwis back here in New Zealand think they’re all going to leave Australia and come back to New Zealand.

“It’s wrong but we’ve convinced ourselves it’s going to happen and so we’ve bought houses before they do.”

In New Zealand, Knight Frank partners with Bayleys Real Estate and research analyst Ankur Dakwale, who is part of Knight Frank’s global research team.

Dakwale told OneRoof that while the full impact of New Zealand’s current lockdown had yet to be seen, there was more certainty of a light at the end of the tunnel this time around, even if Kiwis don’t know yet how long the tunnel is.

He said record low listings were also adding fuel to the market, with demand outstripping supply.

“You get a situation of frustrated buyers because we can’t buy the house we want and what’s holding current householders back is they know they’re going to go into this pool where they can’t find another house so they’re not listing as well.”